Congratulations! and on behalf of Pune District Central Co-operative Bank Ltd, we welcome you to the ATM services offered by our bank, the most modern form of cash is now yours. Pune District Central Co-operative Bank has launched Rupay Debit Card in association with NPCI. You can now conveniently avail anywhere, anytime 24 hour banking services as well as do hassle-free shopping. The guidelines for usage of card is mentioned in the User Guide and Terms and Conditions Document. First usage of the card at our ATM or any other Bank's ATM amounts to your acceptance of the terms & conditions mentioned in the User Guide and the Terms & Condition Document. Looking forward to a long and valuable relationship.

Rupay Debit Card User Guide

Step 1: Insert your card and pull it back into the slot provided.

Step 2: The ATM will prompt you to select your preferred language.

Step 3: Next, the ATM will prompt you to enter your PIN.

Step 4: If you're PIN is correct, you will be provided with the list of transaction options, viz. Fast Cash, Cash withdrawal, Balance Enquiry, Mini Statement, and Change PIN. Select the desired transaction and follow the instructions.

Step 5: In case of Cash Withdrawal your account with your Bank will be debited online with the amount of withdrawal.

Step 6: If you have no further transactions, collect your card.

Step 1: Look for Rupay Logo in Merchant Establishments. The card is accepted at all MEs in India which display the Rupay Logo and have POS Terminal.

Step 2: Complete your purchase and then present your card for making payments for purchase make/services availed.

Step 3: The merchant will swipe the card at the POS Terminal and purchase amount will be entered.

Step 4: You will be presented with the PIN pad. Enter the same PIN which you use at an ATM to withdraw money.

Step 5: The POS Terminal will process your transaction by debiting your account with your Bank with the purchase amount(subject to availability of funds in your account) and print a charge slip.

Step 6: Check the correctness of the amount and other details on the charge slip and sign the charge slip. Your signature must match with that on the card.

Step 7: The transaction is complete. Ensure that the card is returned to you along with the copy of the Charge slip. Preserve the charge slip for your future reference as the bank will not furnish Copies of the Charge Slip.

E-commerce/Online transaction:

For e-commerce/online transactions use card no., expiry date, CVV no. and get OTP on register Mobile No.

FRONT

1. Card Number: This is your unique 16 digit card number. Please quote this number in all your correspondences / communications with the Bank.

2. Your Name: Only you are authorized to use your card. Please check to see that you’re Card has been correctly indent printed. If not, Contact your branch at earliest.

3. Validity: The card is valid until the last day of the month of the year indicated on the card.

4. Rupay Logo: Any merchant establishment and ATM displaying Rupay logo should accept your Card in India.

5. EMV Chip: EMV Chip stores Values of the card. Do not scratch the chip.

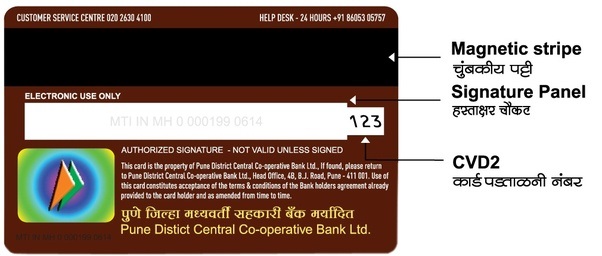

BACK

1. Magnetic Stripe: Important information pertaining to your Card is encoded here. Protect your card from scratching or exposure to magnets or magnetic fields as it can damage the magnetic stripe.

2. Signature Panel : Sign on the signature panel with non-erasable ball point pen(preferably black) on receipt of your card.

3. Card Verification Data 2(CVD2): The CVD2 number that provides a cryptographic check of the information embossed on the card that help us validate you, the legitimate cardholder of the card, who is making online purchase.

Immediate Payment Service is an interbank electronic instant mobile money transfer service through mobile phones. Our IMPS service helps you access your Bank Account and transfer funds instantly. The beneficiary account is credited immediately when a Fund Transfer request is made through your Mobile phone is an interbank electronic instant mobile money transfer service through mobile phones. Our IMPS service helps you access your Bank Account and transfer funds instantly. The beneficiary account is credited immediately when a Fund Transfer request is made through your Mobile phone ccount and transfer funds instantly.

| Number Of Branches | 17 |

| Number Of ATM | 17 |

| Branch Name | Branch Code | Branch Address | Contact Number |

|---|

| ATM Name | ATM Address |

|---|

So instead of keeping that gold jewellery, coins, bars or biscuits lying ideal in your locker, you sure could use them to meet those cash contingencies.